When people first research the industry, they often search for a forex broker guide, ask how to become a broker in forex trading, or look for information on how much it costs to open a forex broker. All these questions point to one starting point: understanding what a forex brokerage actually is and how it operates as a business.

A forex brokerage provides traders with access to the currency market through trading platforms, client accounts, and a structured operational environment. It is a mix of financial services and technology infrastructure, and knowing how these pieces fit together helps future founders plan properly.

1. Forex Brokerage Explained: The Business Behind the Platform

A brokerage handles:

- Account registration and onboarding

- Verification and compliance procedures

- Deposits, withdrawals, and internal transfers

- Connection to a trading platform

- Order routing and execution

- Daily reporting and support for traders

From the trader’s point of view, they log in, fund their account, and trade. From the operator’s point of view, it’s an organized system of legal, technological, and financial processes that must be maintained every day.

This article works as a business-focused forex broker guide, rather than a technical glossary.

2. How a Forex Brokerage Generates Revenue

Brokerage revenue typically comes from:

- Spreads added on top of raw liquidity

- Commissions charged per transaction

- Swaps for overnight positions

- Value-added services like education, copy trading, analytics, or premium tools

Your approach — pure A-book, full B-book, or hybrid — directly influences your operating model and should be reflected clearly in your broker business plan.

3. Your Forex Trading Platform for Your Business

Clients interact with your trading platform more than any other part of your system. When choosing a forex trading platform for your business, evaluate:

- Supported asset classes

- Execution quality

- Ultrafast order routing

- Platform stability

- Hosting approach

- Integration with CRM and payments

- Licensing model (white-label or full server license)

Popular platforms in the industry include MT4, MT5, cTrader, Match-Trader, DXtrade, and TradeLocker. Each fits a different type of brokerage, so the decision should match your client base, markets, and planned scale.

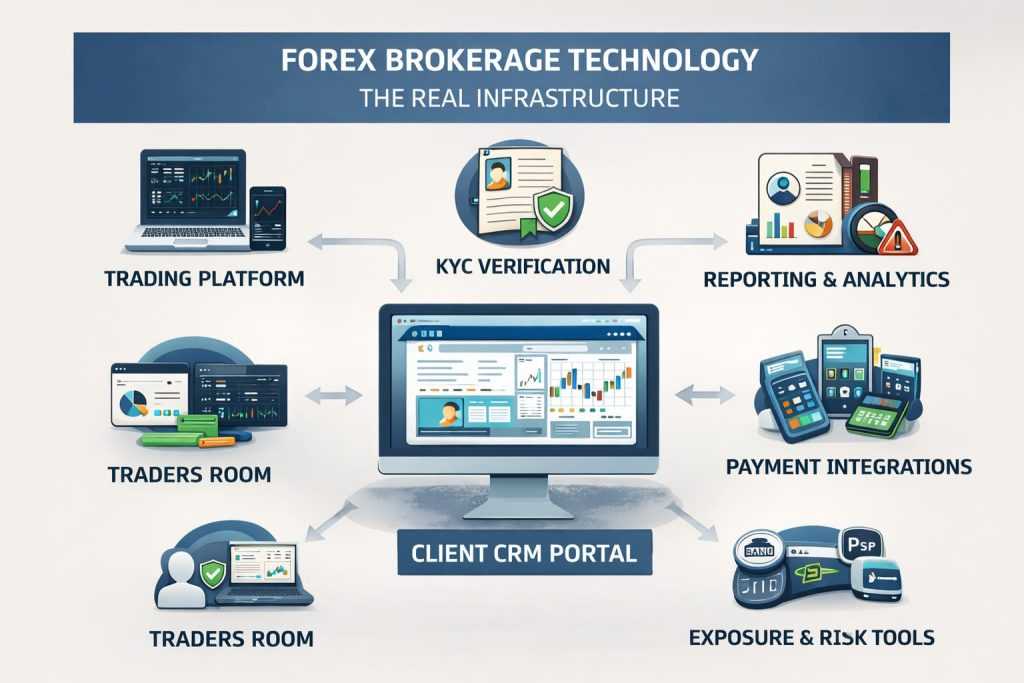

4. Forex Brokerage Technology: The Real Infrastructure

A forex brokerage runs on more than just a trading terminal. Your full forex brokerage technology stack often includes:

- Trading platforms

- CRM for operations, support, and compliance

- Traders Room / Сlient portal

- KYC and document verification system

- Payment integrations (multiple PSPs, banks, wallets)

- Reporting and analytics

- Risk tools and exposure monitoring

This is why selecting the right CRM and client portal is crucial. It becomes the center of your back office and links all moving parts togethe

5. Forex Trading Franchise: White-Label Brokerage Model

A large number of first-time operators start with a forex trading franchise model, effectively a white-label arrangement. This allows a new broker to operate under its own brand while relying on the provider’s existing infrastructure.

A strong white-label usually includes:

- A branded trading platform

- Liquidity already connected

- Hosting and server environment

- Platform maintenance and updates

- On-demand technical support

- Faster time to market

- Lower setup costs

This model helps new brands “open” a forex broker quickly, validate their concept, and onboard clients without heavy initial expenses. As volumes grow, many firms transition to a full platform license for more control over conditions, routing, and long-term profitability.

6. How Much Does It Cost to Open a Forex Broker?

When people search how much does it cost to open a forex broker, they are usually trying to understand the big picture. Costs depend on whether you choose white-label or independent setup, as well as your jurisdiction.

A typical cost structure includes:

Business & Legal Foundation

- Company formation

- Legal advisory

- Licensing or registration (varies widely)

- Bank accounts and payment partnerships

Technology Stack

- Trading platform setup

- Monthly platform licensing

- CRM and client portal

- Bridge/aggregator for liquidity

- Servers and hosting

- Risk tools and reporting systems

Operational Structure

- Compliance

- Support staff

- Marketing and acquisition

- IT upkeep

- Ongoing licensing renewals

- PSP fees and banking costs

White-labels reduce upfront spending, while full-license setups increase both initial cost and long-term operational control. Your final number depends on region, size, and operational design.

7. Planning the Business: Broker Business Plan

Every brokerage needs a clear and well-structured broker business plan before committing to contracts or purchasing technology. This document guides your decisions and prevents overspending.

A strong business plan outlines:

- Target countries and languages

- Regulatory path

- Product offering and trading conditions

- Technology stack (CRM, platforms, payments)

- Budget and financial projections

- Marketing channels and client acquisition flow

- Risk model and A-book/B-book split

Many new founders underestimate how much clarity this document brings. It shapes nearly every operating decision you will make later.

8. How To Become a Broker in Forex Trading: Step-by-Step

Starting a brokerage follows a predictable order. First, you set up the business itself: choosing where the company will be registered, defining your model, and preparing the legal foundation. From there, you choose the technology that powers the operation — a trading platform, your Kenmore Design CRM, and the Kenmore Client Portal traders will use to register, verify, deposit, and manage their accounts.

After the technology is in place, brokers typically integrate liquidity, configure spreads and leverage, and apply the risk rules that shape the trading environment. Compliance comes next, with KYC/AML tools already built into the CRM, followed by the client-facing website and onboarding process.

Once everything works end-to-end, the brokerage runs internal tests and then begins accepting its first clients.

In simple terms, becoming a broker means:

- forming the company,

- choosing your platforms and CRM,

- connecting liquidity and risk tools,

- enabling compliance,

- launching your website and client portal,

- testing the entire flow,

- and opening the doors to traders.

Conclusion: Where the Brokerage Truly Operates

A forex brokerage is more than a place where traders execute orders. It is a business built on structure, regulation, technology and the trust traders place in the brand. Trades happen on the platform, but almost every operational task that keeps the brokerage running happens inside the CRM and the systems connected to it. This includes onboarding, verification, payments, account settings, communication, reporting and compliance.

When these elements work together in a reliable CRM environment, a brokerage can operate predictably, scale responsibly and offer traders a smooth, transparent experience. Understanding this framework helps new founders see that the real engine of a brokerage is not the trading screen. It is the infrastructure that supports the entire client lifecycle.

Request a Consultation on Starting a Forex Brokerage

Get expert guidance on launching a forex brokerage with the right structure from day one. We’ll help you understand brokerage models, technology requirements, costs, and the decisions that shape long-term scalability — from platforms and CRM to payments and compliance.

Together, we’ll review your goals and outline a clear roadmap for opening a forex broker that is operationally sound, compliant, and built for growth.