Understanding Forex Payment Gateways & PSP Aggregators for FX Brokers:

Efficient funding and payout infrastructure can define the success of a brokerage. While regulated FX brokers rely on compliant banking and PSP integrations, emerging brokers often face challenges such as onboarding delays, regional payment restrictions, chargeback risks, and evolving KYC standards.

This guide explains how Forex payment gateways, PSP aggregators, crypto rails, bank transfers, and risk controls fit together — and what brokers should consider when designing their payment stack.

Looking for the product overview?

Visit the dedicated page: Forex Payment Solutions

Why Forex Payments Are Different

- Traders expect instant crediting and fast payouts across multiple regions.

- Funding must connect to KYC status, trading accounts, and internal ledgers.

- Risk and compliance teams need audit trails, chargeback handling, and alerts.

Unlike typical e-commerce, FX payments must integrate identity checks, account verification, platform balance logic, and anti-fraud flows.

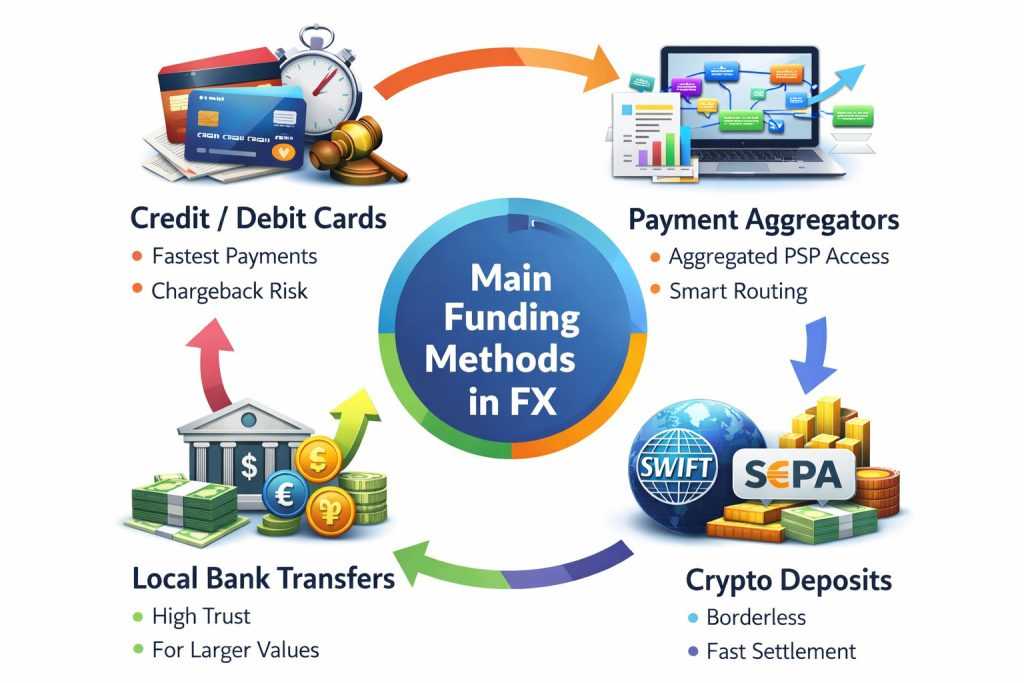

Main Funding Methods in FX

- Credit/Debit Cards: Fastest deposits; chargeback risk; requires robust dispute handling.

- Payment Aggregators: Access to multiple PSPs; smart routing; redundancy; unified reporting.

- Local Bank Transfers: High trust in-region; useful for larger values and regulated brokers.

- SWIFT/SEPA: Standard for bigger withdrawals and corporate accounts.

- Crypto Deposits: Border-agnostic; fast settlement; needs AML screening and conversion.

How Deposit Verification Usually Works

- Client initiates a deposit in the Trader’s Room or Client Portal.

- KYC status and account eligibility are verified.

- PSP or bank transfer is executed (or crypto initiation starts).

- Broker or automated logic confirms funds and risk checks.

- Balance is credited to the trading platform wallet or account.

Some brokers enable instant balance credit with trusted PSPs; others use a verify-and-release flow.

What Is a PSP Aggregator?

A PSP aggregator connects multiple payment providers into a single interface.

Advantages include:

- Multi-provider backup to reduce decline risk

- Geo-routing (EU cards → EU PSP, LATAM → LATAM PSP, etc.)

- Unified reporting and settlement visibility

- Rules-based routing and compliance checks

In Forex, aggregator logic often includes linking deposits to trading accounts, enforcing KYC tiers, and triggering risk alerts.

Bank Transfers & Local Rails

Bank transfers remain critical for regulated brokers, high-value clients, and regions with strict card rules.

Local rails such as PIX, ACH, and SEPA Instant further improve approval rates and speed within their jurisdictions.

Crypto Funding in FX

Crypto is now a major deposit channel for global brokers due to fast settlement and global reach.

Ensure the following:

- AML/KYT screening on chains and addresses

- Clear confirmation thresholds before crediting balances

- Conversion partners for USDT/BTC → fiat and proper treasury procedures

Provider Selection Checklist

- Licensing: Explicit support for FX/CFD vertical

- Risk & Disputes: Chargeback tooling, velocity rules, fraud models

- Fees: Processing, FX spread, settlements, minimums

- Settlement: Timing, currencies, reconciliation files

- Tech: API, webhooks, routing logic, uptime history

- Compliance: KYC/AML, crypto AML/KYT, audit logs

- Support: Merchant support SLAs, incident communication

Why CRM Integration Matters

- Trader’s Room / Client Portal

- KYC and compliance module

- Trading platform balance and wallets

- Internal accounting and finance reporting

- Risk and alerting systems

This is where industry-specific experience matters — general PSPs rarely provide the trading-platform workflow logic brokers need.

Operational Automation

- Automatic deposit confirmation by method, amount, or KYC tier

- Wallet and platform synchronization

- Crypto confirmation tiers and alerts

- Suspicious pattern monitoring

- Unified reports for finance and compliance

How Kenmore Design Fits In

Kenmore Design provides infrastructure where brokers connect card PSPs, aggregators, bank rails, and crypto settlement systems with KYC, risk logic, and trading platform balances — creating a robust brokerage-grade workflow.

Conclusion

FX payments aren’t just “checkout and approve.”

Brokers need reliable routing, global coverage, crypto infrastructure, KYC and risk logic, platform balance automation, and compliance-ready reporting to deliver a better trader experience and protect revenue.

Request a Consultation on Designing a Forex Payment Infrastructure

Get expert guidance on structuring a reliable and compliant payment stack for your forex brokerage. We’ll help you evaluate PSPs, aggregators, bank rails, and crypto funding options—ensuring they align with your regions, risk profile, and operational goals.

Together, we’ll review your business model and outline a payment strategy that supports fast funding, smooth payouts, and long-term scalability.